With the month of October comes the crisp autumn air, shorter days, witches and other scary Halloween creatures. But did you know that, while workplace accidents are always frightening, during the month of October the impact of an accident on the company’s financial CNESST file can be downright terrifying?

When a workplace accident occurs, generally all related costs are applied to the employer’s CNESST file, which in turn becomes the basis for the calculation of the company’s annual CNESST premium. This applies specifically to mid-sized companies with an annual CNESST premium of $7,500 and $425,000. This currently represents approximately 55 000 employers in Quebec. More specifically, an employer’s annual CNESST premium is based on the costs related to any workplace accidents that occurred in the company over the past four years. For example, if an accident occurred in 2018, the CNESST will include all costs related to the accident up until December 31, 2021 including payments to replace lost wages, the cost of medical treatments and consultations, medication, etc.

So the greater the expenses associated with an accident, the greater impact it will have on an employer’s financial CNESST file. Seems logical? But did you know that the seriousness of an accident can also influence the calculation of the total cost of the accident? The greater the risk that an injury will cause long-term expenses, the more these costs will be subject to higher cost factors when calculating the financial impact on an employer’s file.

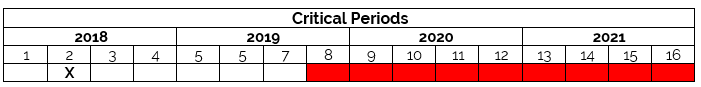

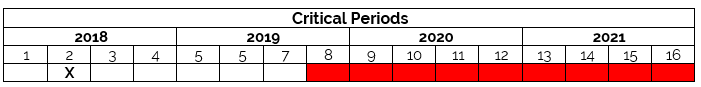

Critical Periods

Certain trimesters represent critical periods during which accidents are subject to very high cost factors. During these trimesters, the CNESST can apply over 4 times the actual cost of the accident to the employer’s financial file. The first trimester affected by this change in calculation factor is the trimester “8”, which begins the 1st of October of the second year since the accident occurred and ends at the end of the 4th year (see table). As soon as costs are generated during the period indicated in red, higher cost factors are applied and the impact on the annual premium will be higher as well.

As an example, for an accident which occurred in April 2018 (trimester 2), the critical period begins October 1, 2019 (trimester 8) and ends December 31, 2021 (trimester 16). Hence the importance of reducing the costs of any ongoing CNESST claims during this particular period. So while the management of any accident files should be done on an ongoing basis, it becomes even more imperative as October 1st approaches. A detailed analysis of all prior accident files should be done to validate if any actions can be taken to reduce the employer’s cost during this period, such as bringing employees back to work all while respecting their capabilities and any temporary functional limitations.

Planning an employee’s return doing light work, with his/her doctor’s consent, permits not only the employer to limit the financial impact of the accident but also has many advantages for the employee. Not only does it promote the worker’s rehabilitation while he progressively regains his full capability, but it also helps avoid the negative effects of prolonged inactivity and allows him to return to his full salary. Everyone wins!

NEED HELP?

Need help with any with your company’s health & safety practices? We can help! To obtain a free one-hour consultation, please get in contact with us here.

Our consulting services can help you take advantage of the numerous benefits of a proper management of health and safety.